Staying Calm in the Storm: Reflections from the IHSG Turmoil

I’m writing this while sipping a very strong matcha latte, trying to make sense of a week that felt more like a rollercoaster ride through a thunderstorm than a typical trading session. If you’ve been checking your portfolio lately and feeling that familiar pit in your stomach, believe me, I hear you. It’s been a rough few days for the IHSG.

Watching over US$ 150 bn (if we’re using monthly intraday high of 9174 and intraday low of 7487) in market value evaporate is enough to make anyone want to delete their investment apps and go back to keeping cash under the mattress.

Then, of course, there’s the very fresh recent "drama" at the top. Seeing a wave of resignations across our regulatory bodies feels a bit like watching the pilots jump out of the plane while you're still in seat 14B (or 1A if you’re lucky).

It’s unsettling, it’s noisy, and it’s perfectly normal to feel a bit rattled.

But if there’s one thing I’ve learned from years of navigating the quirks of the Indonesian market, it’s that the noise is temporary, but the principles are permanent.

When the Tide Goes Out

Warren Buffett always says you only find out who’s swimming naked when the tide goes out. This week, the tide didn't just go out; it vanished. The regulatory shake-up, while chaotic, actually a sign of the market "growing up." We’re flushing out the lack of transparency and the "hidden hands" that have kept our market from reaching its true potential. It’s painful "spring cleaning," but it’s necessary if we want a market that actually rewards honest growth.

For our markets to mature from an emerging status to a global powerhouse, transparency isn't just a luxury; it is the foundation. Short-term volatility is the price we pay for long-term liquidity. If these reforms mean that "ultimate beneficial owners" can no longer hide in the shadows, then the market that emerges will be far more resilient than the one we left behind in 2025.

The "Nasi Campur" Strategy: Why Diversification Matters

If this rout has taught us anything, it is that "concentration creates wealth, but diversification preserves it." Many local investors were heavily tilted toward a few high-flying conglomerate stocks that MSCI specifically flagged. When those "pillars" shook, their entire portfolios crumbled.

I’ve noticed a pattern: the investors who are panicking the most right now are the ones who were "all-in" on just one or two big conglomerate stocks. They chased the hype, and when those pillars shook, their whole house came down.

Diversification isn't just a boring word from a finance textbook. It’s your insurance policy against the unknown. If your portfolio is well-diversified, this market rout shouldn't feel like a fatal blow. It should feel like a stubbed toe. Annoying? Yes. Life-threatening? Not even close.

Building Your "Fortress" in Indonesia

If you’re wondering how to actually build a "fortress" around your wealth in this climate, here is how I think about it. It’s not about finding the next "moonshot"; it’s about Rule No. 1: Don’t lose money. Rule No. 2? Refer back to Rule No. 1. The best way to follow those rules is to allocate your assets based on your actual life needs, not whatever is trending on social media. If you’re just starting your investment journey, my advice is to lean into the "quiet" assets. Money market instruments and fixed income funds might not be the talk of the town during a bull run, but they are your best friends during a rout. They act as your portfolio’s shock absorbers, protecting you from the stomach-churning volatility we’ve seen lately.

Think of these safer assets as your "dry powder." When high-quality companies get unfairly punished and their stock prices become ridiculously cheap, cash is king. Having your money in stable instruments means you aren't just surviving the crash; you’re in a position to profit from it when the dust settles.

If your portfolio is currently anchored by money market funds and those "vanilla" (but reliable) fixed income funds, you’re likely sleeping soundly tonight despite the headlines. You’re in the clear. Keep that discipline; some truly great buying opportunities in the equity market are starting to peek through the chaos.

However, if you find yourself "all-in" on equities right now, or worse, knee-deep in those hyped-up conglomerate stocks that took the biggest hit, don’t spiral. We’ve all been there. In Part 2 of this letter, I’ll be diving deep into how you can refine your strategy to minimize your downside risk and start rebuilding a foundation that can actually withstand the next storm.

A Final Thought

Market panics are like Jakarta rainstorms. They come out of nowhere, they cause a massive traffic jam, and they make everything look messy. But they also wash away the dust collecting on our cars that haven’t seen the good side of the sponge in weeks.

We aren't here for a quick flip. We’re here to build long-term wealth that survives the 2026 rout, the 2030 fluctuations, and whatever comes after. My advice? Take a deep breath. Don't make decisions based on a red screen. If your portfolio is diversified, you’ve already done the hard work. Now, you just have to wait for the sun to come back out.

We’re in this together. Stay disciplined, stay calm, and please, stop checking your app every five minutes.

Lihat Blog Lainnya

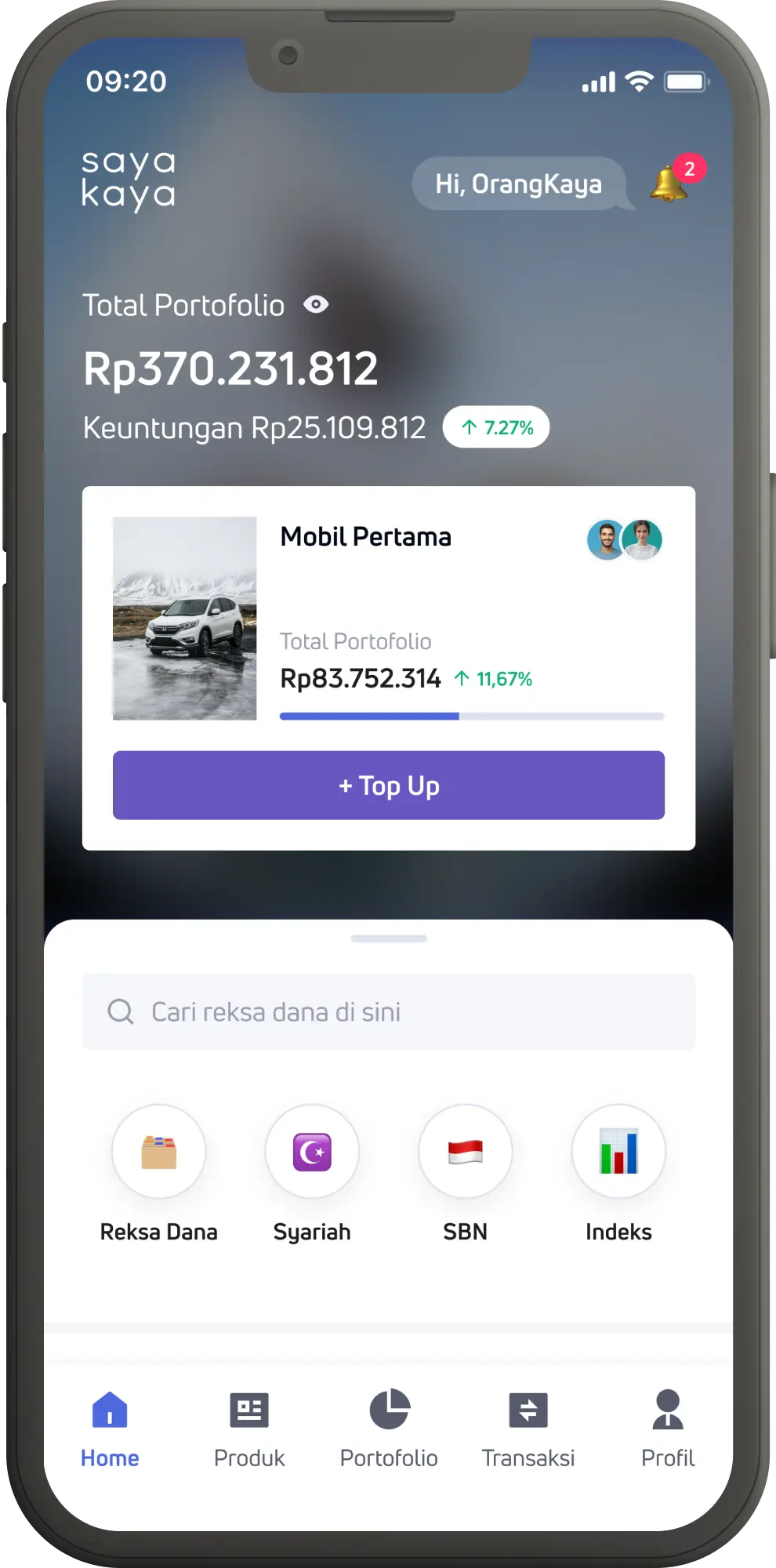

Dari Gaji ke Aset: Bagaimana Cara Orang Indonesia Bisa Membangun Kekayaan

Bagi banyak orang Indonesia, gaji seringkali hanya menjadi alat untuk bertahan hidup dari satu bulan ke bulan berikutnya. Gaji datang, dibagi untuk berbagai memenuhi berbagai kebutuhan, lalu tak lama habis. Pola ini terasa wajar dan umum terjadi di banyak orang. Namun, pola tersebut adalah pola yang tidak bisa membangun sebuah kekayaan.

Baca Selengkapnya

Promo EMERGENCY

Hai Teman Yamin! Indeks Harga Saham Gabungan (IHSG) mengalami tekanan hingga 8% ke level 8.261, yang memicu penghentian sementara perdagangan (trading halt) di Bursa Efek Indonesia. Untuk membantu kamu tetap berinvestasi, SayaKaya menghadirkan promo EMERGENCY.

Baca Selengkapnya

Promo ANGPAO Spesial SayaKaya Extended

Hai Yamin! Dalam rangka menyambut momen spesial Chinese New Year, SayaKaya memperpanjang promo Angpao. Dapatkan Angpao eksklusif dengan berbagai desain pilihan sebagai bentuk apresiasi atas investasimu. Yuk, simak mekanisme serta syarat dan ketentuannya sebagai berikut!

Baca Selengkapnya